41 are gift card taxable

Are Employee Gift Cards Considered Taxable Benefits? - Strategic HR Yes, it's true! According to the IRS, cash, gift certificates, and gift cards are considered taxable fringe benefits and must be reported as wages. But you may be relieved to know that this rule doesn't apply to all gifts or perks that you may give to employees. Reminder: Holiday Gifts, Prizes or Parties Can Be Taxable Wages - SHRM Employers planning on giving gift cards this season should remember that the IRS regulations support treating all gift cards and gift certificates provided to an employee as taxable income.

Should I tax customers for gift cards? - Avalara More important, however, is that recipients of gift cards are going to be charged sales tax when they use their card -- if the state they're shopping in imposes a tax on the product they've purchased. For example, if you send your cousin in Pennsylvania a Banana Republic gift card, she won't need to pay sales tax on clothing when she uses it.

Are gift card taxable

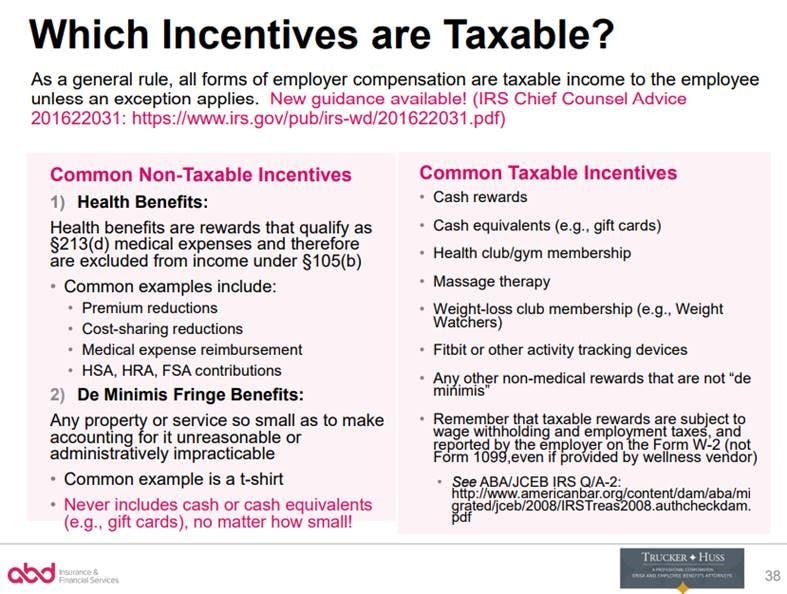

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? Team Gift Type 2: Gift Cards and Certificates. Gift cards and gift certificates are considered taxable income to employees because they can essentially be used like cash. The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards Are Gift Cards Taxable Income to Employees? - LinkedIn If you give your employee a VISA gift card to purchase a holiday ham, it is income to the employee, subject to payroll and income taxes! Get More Help IRS Publication 15-B "Employer's Tax Guide To ... You Mean Gift Cards Are Taxable? · PaycheckCity Each card has value and is essentially cash to a store of some kind. Whenever cash is exchanged, it is a taxable transaction to an employee. The argument is always that gift cards or cash under $50 in value are "de minimus" or too small to account for. However, there is no such limit that has ever been published by the IRS.

Are gift card taxable. Are Gift Cards Taxable Income? | Sapling Gifts Are Not Income If you get a gift card as an actual gift -- as a present from a family member or friend, say -- then it's not taxable income. You don't have to report it or pay taxes on it. There is such a thing as gift tax, but it's paid by the person giving a gift, not the recipient, and it's unlikely that a gift card would trigger it. Are gift cards taxable income to employees? | Proformative Any gift with a value over $50 (they said it could be stretched to $75) was taxable - even when for a catalogue where the employee chooses their item. Since it was my employer's preference to give gift cards as opposed to cash bonuses, we ended up having to add the value to their wages so they would be taxed appropriately. Must-Know Tax Rules for Employee Gift Cards: 2022 Update - Giftogram In fact, any gift card you award to a customer or prospect is non-taxable, whether it's a just-because gift, a customer incentive, a loyalty reward, or a prize won through a promotional contest. Tax Rules for Gift Cards to Employees Gift cards to employees are always taxable, but following the rules doesn't have to be time-consuming or complicated. Are gift cards taxable? | Kroger Gift Cards Yes, gift cards are taxable when received when given to an employee from an employer. Employees will have to claim any funds received on gift cards from their employer in their tax return. Employers will also have to pay tax on any gift cards they give to employees. The IRS will expect tax to be paid on gift cards, even in values as low as $5.

Are gift cards taxable employee benefits? | PeopleKeep Yes, gift cards are taxable when offered to employees. The IRS considers it as cash-equivalent, meaning you must report the card's value on an employee's Form W-2 just like a wage. This is the same as taxable fringe benefits such as employee stipends, which must also be reported as wages on employees' W-2s. PDF New IRS Advice on Taxability of Gift Cards Treatment of ... - IRS tax forms Some employers believe that gift cards are not taxable and qualify as excludable from income as a de minimis fringe benefit because ... a turkey or a ham as the equivalent of giving an employee a gift card to purchase a turkey or a ham. A recently issued Tax Advice Memorandum (TAM) in 2004 clarifies the tax law and ... Are gift cards from rewards sites taxable as income? - Intuit The value of the gift cards are taxable income. Please report this under this here: Federal taxes - Wages & income - I'll choose what I work on - Less common income - Misc income 1099-A 1099-C If your screen looks different than mine, it may be because you are using a different version of TurboTax than I am. Gift certificates Ask the Expert: Are All Gift Cards Taxable Income? - HR Daily Advisor So the short answer would be that any gift card that serves as a cash equivalent - for example, a $25 Amazon.com gift card or a Visa cash card - would always be taxable regardless of the amount because there is no difficulty in accounting for the monetary value of the gift.

Are Gift Cards Taxable to Employees? - Eide Bailly When it comes to gift cards, however, the requirements are clear: regardless of frequency or the amount of money you paid, gift cards must be reported as part of your employees' wages. For additional resources on fringe benefits rules and exclusions, see IRS Publication 15-B, Employer's Tax Guide to Fringe Benefits. De Minimis Fringe Benefits | Internal Revenue Service - IRS tax forms Cash or cash equivalent items provided by the employer are never excludable from income. An exception applies for occasional meal money or transportation fare to allow an employee to work beyond normal hours. Gift certificates that are redeemable for general merchandise or have a cash equivalent value are not de minimis benefits and are taxable. Are Gift Cards Taxable? | Taxation, Examples, & More Yes, gift cards are taxable. According to the IRS, gift cards for employees are considered cash-equivalent items. Like cash, include gift cards in an employee's taxable income—regardless of how little the gift card value is. But, there is an exception. Are gift cards given by Amazon taxable income? - Intuit In the order details, I can see that they applied for a 200 dollar gift card, which was given to me because I signed for the credit card. Is this bonus/gift card a taxable income? Also, Amazon gave me courtesy credit in form of a gift card a couple of times (like 5 dollars, 10 dollars). Are those gift cards taxable?

Are tangible gifts taxable? - tts.rescrf.com Like cash, you must include gift cards in an employee's taxable income—regardless of how little the gift card value is. Are tangible gifts to employees taxable? Gifts awarded for length of service or safety achievement are not taxable, so long as they are not cash, gift certificates or points redeemable for merchandise. Tax-free value is ...

Are Gift Cards taxable | Tax on Gift Cards|Blackhawk Network However, gifts-even in the form of money or gift cards-have tax consequences that companies should consider. Everything you need to know about taxable gifts. You must withhold all related federal and state personal income taxes if the gift is declared taxable income to the employee. For these numbers, you may also pay other job taxes, such as ...

Can I give my employee a gift card without being taxed? Because gift cards are essentially the same as cash, they are considered an easy item to be accounted for and, therefore, taxable. There used to be a threshold of $25 to be the maximum amount that could be gifted before having to be taxed, but that is no longer the case. A gift card or cash equivalent is now taxable, regardless of the amount.

Gift Cards are Taxable! - Southwestern University Gift Cards are Taxable! Per IRS Regulations, gift cards are taxable to the recipient and must be reported as income to the IRS. In addition, because the IRS considers them to be cash equivalents, there is no de minimis value (see 2018 IRS Publication 15-B page 9 De Minimis (Minimal) Benefits). All cash and cash equivalents must be

Gifts to Employees - Taxable Income or Nontaxable Gift? All cash or gift cards redeemable for cash are taxable to the employee, even when given as a holiday gift.; Monetary prizes, including achievement awards, as well as non-monetary bonuses like vacation trips awarded for meeting sales goals, are taxable compensation - not just for income taxes, but also for FICA. Withholding applies.

Are Employee Gifts Taxable? Everything You Need To Know Gift certificates, gift cards and cash equivalent benefits are never tax-exempt This is something the IRS is very clear about. Even if they are given out as holiday or birthday presents from an employer to an employee, these types of gifts are never considered de minimis fringe benefits, and are thus liable to taxation.

IRS Issues Guidance on Treatment of Gift Cards - The Tax Adviser the sale of a gift card (or gift certificate) if: (1) the taxpayer is primarily liable to the customer (or holder of the gift card) for the value of the card until redemption or expiration, and (2) the gift card is redeemable by the taxpayer or by any other entity that is legally obligated to the taxpayer to accept the gift card from a …

Know the tax rules for gifts to employees and customers - Beliveau Law Gifts to vendors, suppliers and customers have their own rules. In general, "thank-you" gifts are deductible by a business up to $25 per person. The $25 figure includes "indirect" gifts to someone (such as a gift made to his or her spouse). Gifts of this sort are typically not considered taxable income to the recipient.

Gifts, awards, and long-service awards - Canada.ca A gift or an award that you give an employee is a taxable benefit from employment, whether it is cash, near-cash, or non-cash. However, we have an administrative policy that exempts non-cash gifts and awards in some cases. Cash and near-cash gifts or awards are always a taxable benefit for the employee.

Are gift cards taxable income? | Taxation, fringe benefits & more As such, the amount of the card is subject to Social Security tax and Medicare tax as well. The rationale behind this makes sense: gift cards are a cash equivalent, and cash paid in addition to employees' regular wages is considered supplemental wages, which are fully taxable. A cash equivalent product provided at work will not exclude income.

You Mean Gift Cards Are Taxable? · PaycheckCity Each card has value and is essentially cash to a store of some kind. Whenever cash is exchanged, it is a taxable transaction to an employee. The argument is always that gift cards or cash under $50 in value are "de minimus" or too small to account for. However, there is no such limit that has ever been published by the IRS.

Are Gift Cards Taxable Income to Employees? - LinkedIn If you give your employee a VISA gift card to purchase a holiday ham, it is income to the employee, subject to payroll and income taxes! Get More Help IRS Publication 15-B "Employer's Tax Guide To ...

Are Gifts for Your Team and Clients Tax Deductible in the U.S.? Team Gift Type 2: Gift Cards and Certificates. Gift cards and gift certificates are considered taxable income to employees because they can essentially be used like cash. The cost of the gift card is fully deductible to the business, but you must withhold taxes from the employee's pay for these gifts. Team Gift Type 3: Awards

0 Response to "41 are gift card taxable"

Post a Comment