44 gift card sales tax

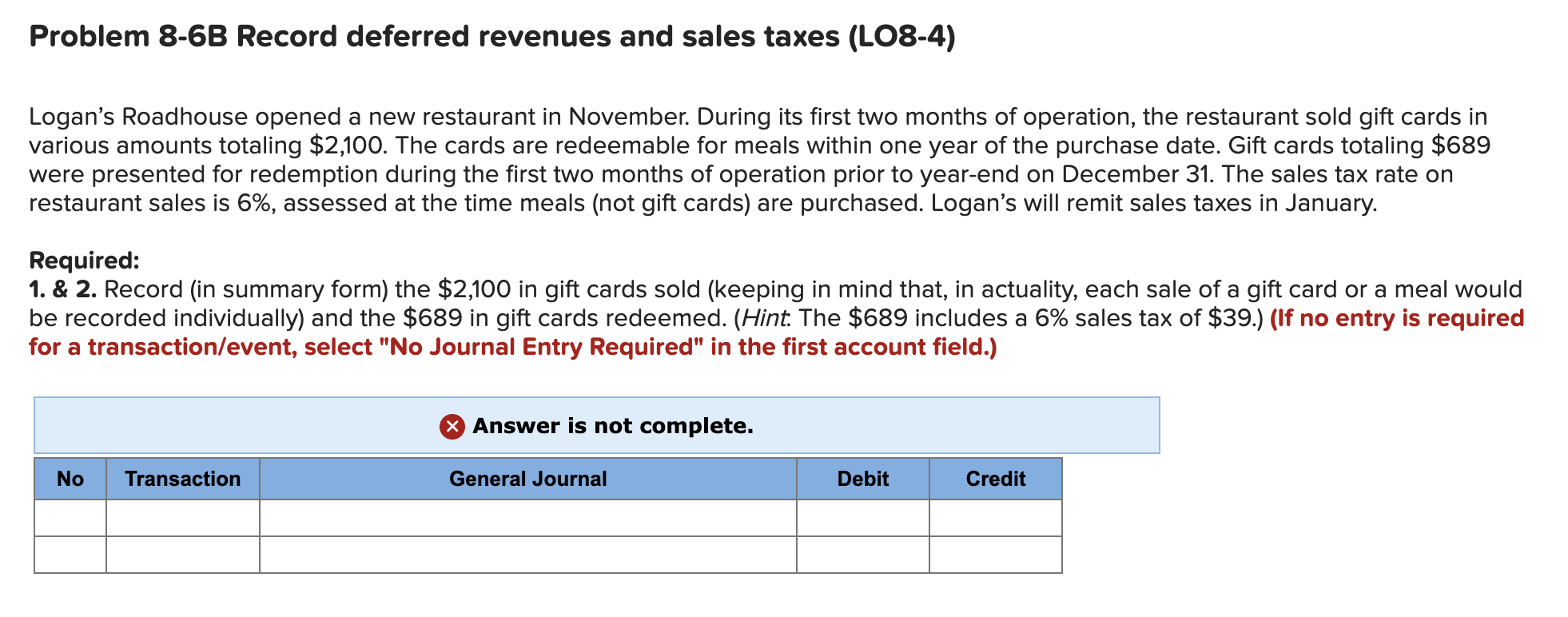

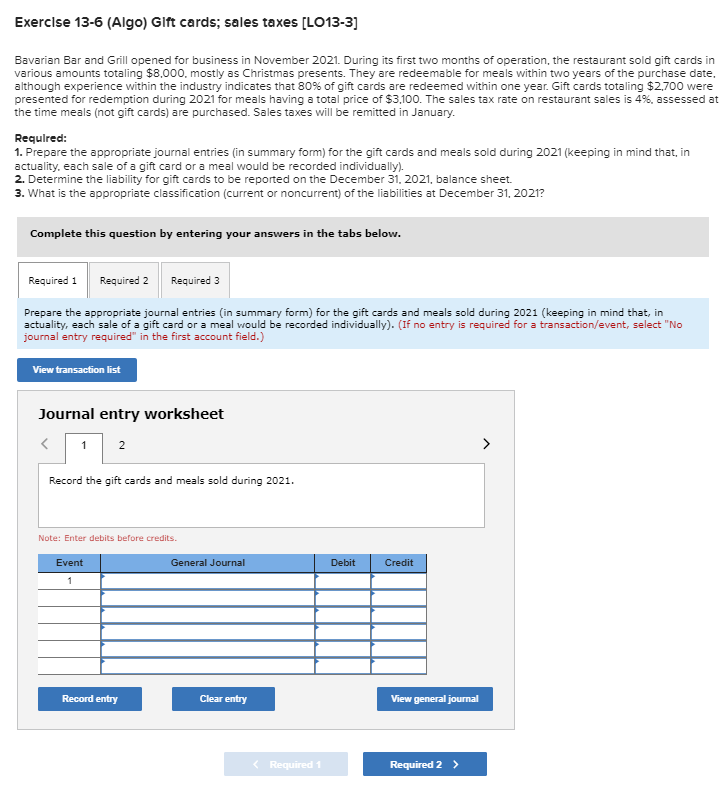

Tax Considerations for Gift Card Sales - Kahn, Litwin Jan 23, 2020 ... For federal income tax purposes, revenue from the sale of a gift card is typically recognized when it's earned, due or collected (whichever ... Sales Tax and Gift Certificates - AccurateTax.com Oct 5, 2022 ... Keep in mind that sales tax is levied when your customer purchases the product. So if the card is purchased in a state with sales tax and spent ...

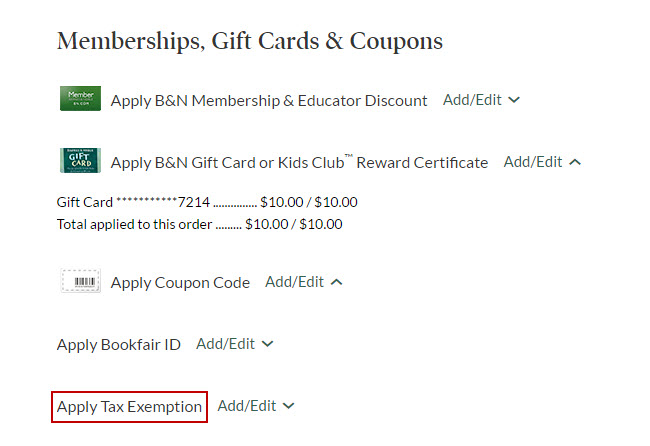

Gift cards, gift certificates, and layaway purchases Taxes do not apply to gift cards and gift certificates at the time of sale. Businesses who issue gift cards and gift certificates should report income when ...

Gift card sales tax

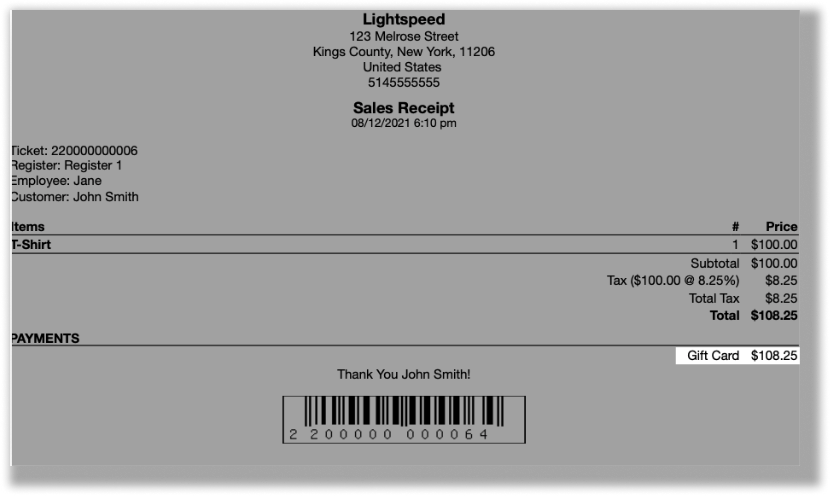

Sales and Use Tax Annotations - 280.0350 - CDTFA - CA.gov Tax does not apply to the sale of gift certificates. Upon redemption of the gift certificates, the value of the certificate is includable in the measure of tax. Tax Guide Topic 38: Gift Cards and Gift Certificates The sale of a gift card or gift certificate is the sale of an intangible "right" to exchange the value of the card or certificate for goods or services. When buying gift cards, make sure you aren't charged sales tax. May 27, 2022 ... The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no ...

Gift card sales tax. Do you pay sales tax on gift cards? - CardCash Apr 29, 2017 ... No. Gift cards are not taxable. The purchase that you buy using that gift card will be taxed, so if tax is paid on a gift card they will be ... Gift cards and sales tax: How not to get duped - CSMonitor.com Aug 26, 2014 ... Many of the major players, like Amazon and Target, clearly state: "No sales tax is charged when purchasing gift cards; however, purchases paid ... Should I tax customers for gift cards? - Avalara Dec 20, 2015 ... More important, however, is that recipients of gift cards are going to be charged sales tax when they use their card -- if the state they're ... Is Gift Card Money Deducted Before or After Sales Tax? Gift cards and gift certificates are to be treated as cash, according to the Federal Trade Commission. No tax should be charged for the purchase of gift cards, ...

When buying gift cards, make sure you aren't charged sales tax. May 27, 2022 ... The sales tax on the monetary value of the gift card is charged when the recipient ultimately uses the card to make purchases, therefore no ... Tax Guide Topic 38: Gift Cards and Gift Certificates The sale of a gift card or gift certificate is the sale of an intangible "right" to exchange the value of the card or certificate for goods or services. Sales and Use Tax Annotations - 280.0350 - CDTFA - CA.gov Tax does not apply to the sale of gift certificates. Upon redemption of the gift certificates, the value of the certificate is includable in the measure of tax.

:max_bytes(150000):strip_icc()/what-difference-between-prepaid-credit-card-and-gift-card_round2-fb12f0c05cc04888832041224c23a9a3.png)

0 Response to "44 gift card sales tax"

Post a Comment